About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Module 21 - Multipliers.

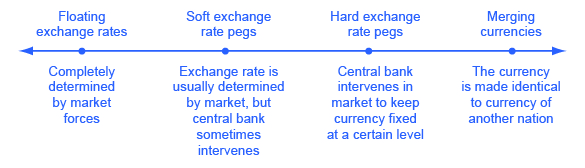

Exchange Rate Policies Macroeconomics

11 Foreign Exchange Market Foreign exchange is highly liquid assets denominated in a foreign currency.

Module 42 the foreign exchange market. Exchange Rate is the price of one countrys currency expressed in another countrys currency. Module 25 - Banks The Fed and Money Creation. Is Globalization a Bad Word.

Fall only in the case of an inelastic supply function. A dealing in capital markets products that are. Chapter 3 - Foreign Exchange FX Markets We will go over three topics.

Ad Discover more trading opportunities with our extensive range of forex crosses. C uncertainty about the value of goods traded internationally. The conversion of currency in a foreign exchange transaction can be performed through.

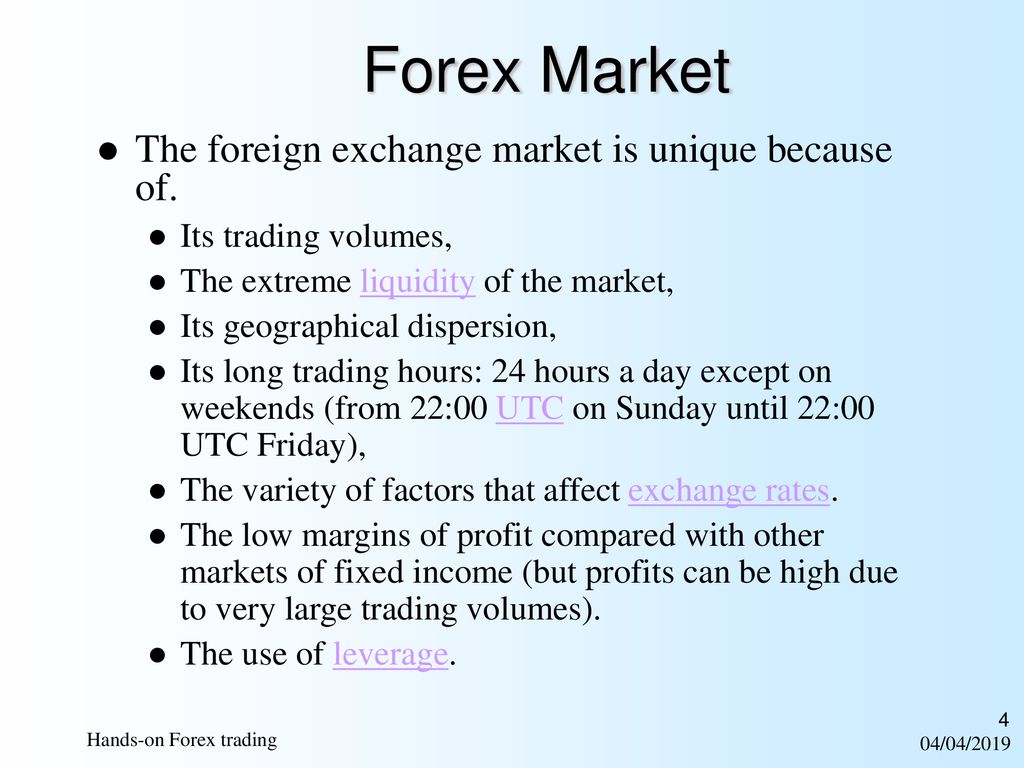

The Foreign Exchange Market 05272014 The Role of the Exchange Rate Weve just seen how differences in the supply of loanable funds from savings and the demand for loanable funds for investment spending lead to international capital flows. Polkadot price to explode to 100 as parachain and crowdloan proposal passes. The forex market is the largest most liquid market in the world with an average daily trading volume exceeding 5 trillion.

Polkadot price has been stuck under the. 1 Exchange Rates definition overview 2 Currency Markets organizati on characteristics players 3 Segments of the FX Market 31. Price of each currency is determined in term of other currencies.

D opportunity cost associated with the accumulation of foreign exchange reserves. Not be predictable with only these facts. The foreign exchange market currency Forex or FX trades currencies.

When the dollar can buy more of a foreign currency like the euro it is said that the dollar has appreciated in value or it has become stronger against the euro. The relative price of two currencies. Or v spot foreign exchange contracts for the purposes of leveraged foreign.

Module 21b - Monetary Policy and AD. Module 45 Putting It All Together. Terms in this set 46 1.

1 mark a Outstanding position b Outstanding Interest c Open position d Open Interest e I am not attempting the question 43 _____ means a depository whose name is entered as such in the register of the issuer. A major drawback of adopting a floating exchange rate is the. Module 43 Exchange Rate Policy and Macroeconomic Policy.

Module 42 The Foreign Exchange Market. Ii units in a collective investment scheme. The purpose of the foreign exchange market is to help international trade and investment.

Module 23 - Stock Market. If both supply and the demand for a good increase the market price will. Foreign exchange market Foreign exchange transaction is a type of currency transaction that involves two countries.

Exchange Rate Policy 431 Exchange Rate Policy Module 43 AP Review Module 44. Borrowing or lending funds. Module 44 Barriers to Trade.

Our forex indices were created with a base level price of 1000 for the USD GBP EUR AUD NZD CAD CNH CHF SEK NOK and SGD indices and a base level price of 20000 for the JPY index as of 31 December 2018. 42 _____ is the total number of outstanding contracts that are held by market participants at the end of each day. The market for a currency like the US.

Buying or selling of goods and services on credit. Section 9 Behind the Demand Curve. The role of the foreign exchange market and the exchange rate The importance of real exchange rates and their role in the current account Understanding Exchange Rates Foreign Exchange Market Exchange.

THE FOREIGN EXCHANGE MARKET MODULE 42 2. Module 43 Exchange Rate Policy. Dollar operates with the forces of supply and demand.

B increased discipline brought on monetary policy. Module 26 - The Federal Reserve. Module 29 - Loanable Funds Market.

Module 24 - Time Value of Money - Present Value. Iv over-the-counter derivatives contracts. Margaret Ray and David Anderson.

Cryptos 1182021 50523 AM GMT. In principle these assets include foreign currency and foreign money orders. All the worlds combined stock markets dont even come close to this.

Module 44 Featured Worksheet Trade Barriers Answer the following questions. Foreign Exchange Market FOREX and Balance of Payments. An exchange rate is a price.

Can bring in all of the wood desired at the world price. The sooner you realize this the sooner you can become successful in trading. No trade equilibrium price is 25 and the world price is 10 assuming that the US.

Module 22 - Savings and Investment. The Foreign Exchange Market 421 The Role of the Exchange Rate Understanding Exchange Rates The answer lies in the role of the The Equilibrium Exchange Rate Inflation and Real Exchange Rates Purchasing Power Parity Module 42 AP Review Module 43. Module 31 - Monetary Policy and the Interest Rates.

It lets banks and other institutions easily buy and sell currencies. Initially the trading of goods and services was by barter system where in goods. Foreign Exchange Markets The market where the commodity traded is Currencies.

Benefit from tight spreads live charts and a fast and intuitive Platform. Consider that the US. Ad Transactions on the interbank market cause all the significant market movements.

Forex also known as foreign exchange FX or currency trading is a decentralized global market where all the worlds currencies trade. Module 41 Capital Flows and the Balance of Payments. Comparative Advantage Culture Clashes and International Organizations.

A foreign exchange rate is the price of one nations currency in terms of anothers. WHAT IS THE FOREIGN EXCHANGE MARKET. Module 29 The Market for Loanable Funds.

Generally a foreign exchange transaction involves conversion of currency of one country with that of another. Iii exchange-traded derivatives contracts. Now assume that the US.

Module 28 The Money Market. Module 44 Exchange Rates and Macroeconomic Policy. What you will learn in this Module.

Introduction to Currency Markets 11 Brief history of foreign exchange markets The current currency rate mechanism has evolved over thousands of years of the world community trying with various mechanism of facilitating the trade of goods and services. When the dollar can buy less of a foreign currency like the euro it is. Rise only in the case of an inelastic supply function.

A distorted incentives imposed on the normal flow of imports and exports. The weighting of each index component is. However most foreign ex-change transactions are purchases and sales of bank deposits.

Module 42 The Foreign Exchange Market.

Introduction To Forex Trading Ppt Download

Scope Of Forex Management Accounting Education

/GettyImages-1132270894-516cf1c783a04c7c98b506d83b59711f.jpg)

3 Common Ways To Forecast Currency Exchange Rates